It should come as no surprise that tracking your investment ideas, successes and setbacks, and using those insights to continuously upgrade your strategy, is critical to the success of every investor.

What does come as a surprise is the lack of tools designed to help investors do exactly that, and how far short the few existing solutions fall.

It surprises us, at least — not just as investors looking to improve ourselves, but as a team of product makers that see a wide open opportunity in the rapidly growing individual investment market.

That combination of personal need and clear market opportunity was what lead us to begin building Fey, a more modern and intelligent trading journal, as our first in-house product.

But to create change, we had to first find out — why are things like this?

In this article, we’ll highlight the current state of the trading journal marketplace, how technology is changing attitudes around personal investing, and why now is the right time to create a product like Fey, designed to help traders of every experience level grow.

The ideal trading journal

The ideal trading journal would help traders:

Understand their baseline investment performance and track their growth

Develop new ideas and monitor positions that they’re not ready to invest in just yet

Keep all notes, charts links and reports organized and quick to access

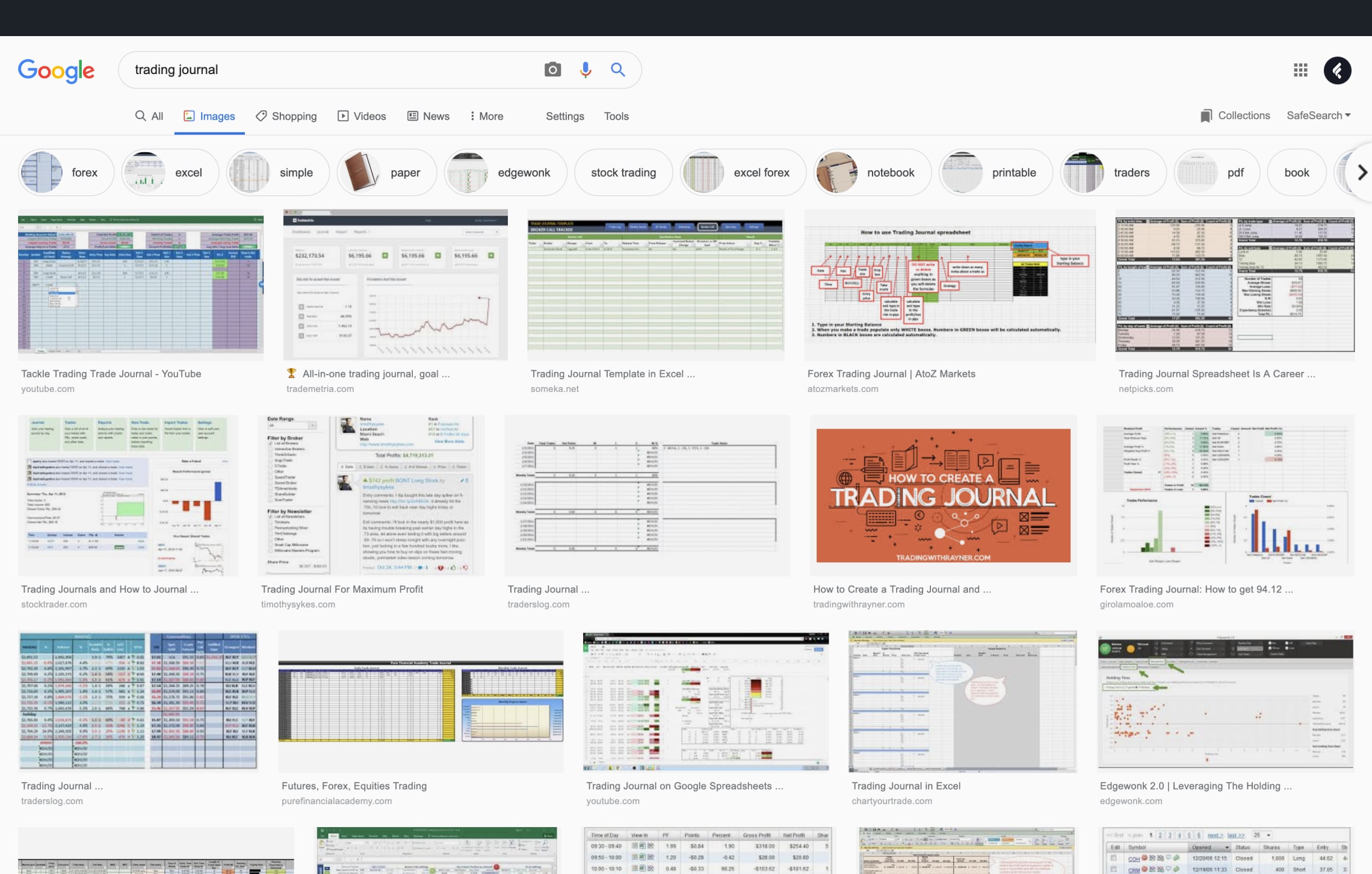

We say the ideal trading journal would help traders because, as far as we can tell, nothing close to the ideal trading journal exists on the market. A search on Google Images for “trading journal” highlights a key problem: everything either looks exactly like Excel, or is literally just Excel.

Indeed, most investors that do keep a trading journal today — including ourselves — use note taking tools like Evernote or Bear to store charts, notes, snippets and 10-Ks, alongside Excel or Google spreadsheets that track research and performance data. In a survey we conducted among people who signed up for Fey early access, 97% of respondents described using this exact workflow.

It’s technically possible to keep some form of trading journal, which is at least better than not keeping one at all. But merely storing data isn’t the goal of trade journaling; learning from and acting on it is. And at every step, these tools get in the way more than they help because they’re simply not designed to help you do anything. They’re designed to store data.

While technology has opened up investing to anyone with a bank account and an internet connection, it’s done little to empower investors outside of the Bloomberg Terminal income bracket to make more thoughtful investment decisions — even as a new generation of young, capital-light investors is on the rise.

A new wave of investors

Search queries for terms like “how to invest” have more than doubled in the past ten years, and grown over 40% in the past three years alone. However, the spike in 2017 — and at least some of this overall growth — is due to the sudden explosion of interest in cryptocurrencies like Bitcoin, the price of which spiked during this same period.

This piece isn’t about cryptocurrency (and the trading journal we’re building isn’t designed around it), but it’s important to acknowledge its impact on growing interest in investing among a previously unengaged audience, and in solidifying the connection between technology and finance.

One company that’s clearly noticed and targeted this audience is Robinhood, makers of a free investing app for stocks, cryptocurrencies and more with over 6 million users, and a company valuation of over $7 billion in its latest round of funding.

The majority of Robinhood’s users are under 35 years old, with many making their first trade ever using the app. Robinhood’s nonexistent barrier to entry, its inclusion of cryptocurrencies and its mobile-first design — the company didn’t launch a desktop browser version until 2017, four years following its launch — all tie into a focus on younger and inevitably less experienced investors.

This shift isn’t just technological, it’s cultural. A Fast Company piece on “How Brokerage App Robinhood Got Millennials To Love The Market” describes how 26-year-old Robinhood user Steven Card’s entry to investing began with brands he personally trusted as a consumer, and lead to him exchanging tips and strategies with his friends:

“If I’ve never heard of the company, I don’t usually feel comfortable buying it,” says Card, who further vets his trades by reading financial statements and texting with a group of childhood friends who have also become Robinhood fans. When a popular company like Tesla posts earnings, they discuss the news: “I’ve known these people for years, but we never talked about this stuff before Robinhood.”

Until recently, the mainstream perception of investing has focused on its inscrutability and potential for financial loss (undoubtedly influenced by the Great Recession at the end of the 2010s). But that intimidation seems to be fading among younger generations, who are beginning to see investing akin to a hobby at its most casual, and a discipline to be honed for traders that become more committed, with educational resources available online for every experience level and type of investing.

However, just because the fear of risk has lessened doesn’t mean that investing has become risk-free. Many fresh investors that have bought into hype over value, or put their emotional interest in a company before its performance, have lost everything in the process.

Vanity dashboards, spreadsheets and high-level how-to articles alone won’t get this done. Investors need more insight into their own personal behavior as an investor: to identify the negative patterns that need examining, the positive patterns worth exploring, and the metrics that indicate long-term success, pulled directly from their own live portfolio.

Fey, the future trading journal

This is the part where we wish we could say we have a tool that solves it all.

Well... we don’t. But we think we will very, very soon.

We’ve been quietly building our trade journaling app, Fey, for quite a while. Earlier this year we opened up early access registration at feyapp.com; anyone that registers for early access will be first on the list to get their one-on-one onboarding when Fey is ready for launch.

Based on our research including a survey of our early access registrants, we’ve identified three key areas where we feel Fey can deliver incredible value where existing options don’t.

Speed: Eliminate the time lost to manual data entry and switching between platforms

Design: Create a beautiful interface that highlights the most valuable information

Community: Stay connected with users and address feedback with product updates

Speed

When we asked people who signed up for Fey early access what their biggest frustrations were in tracking their trades and investments today, the responses overwhelmingly fell into two buckets:

It takes too long to input data, screenshots and snippets

Fragmented across different tools, that data becomes confusing and slow to read

The time and labor involved in manually entering data, copying and pasting screenshots and snippets between different platforms, and keeping it all organized prevent many traders from fully committing to journaling and reaping its full benefits.

To make keeping a trading journal something traders actually enjoy doing — and to help keep them consistently journaling — Fey needs to be exponentially faster than any of the trading journal “solutions” that exist today.

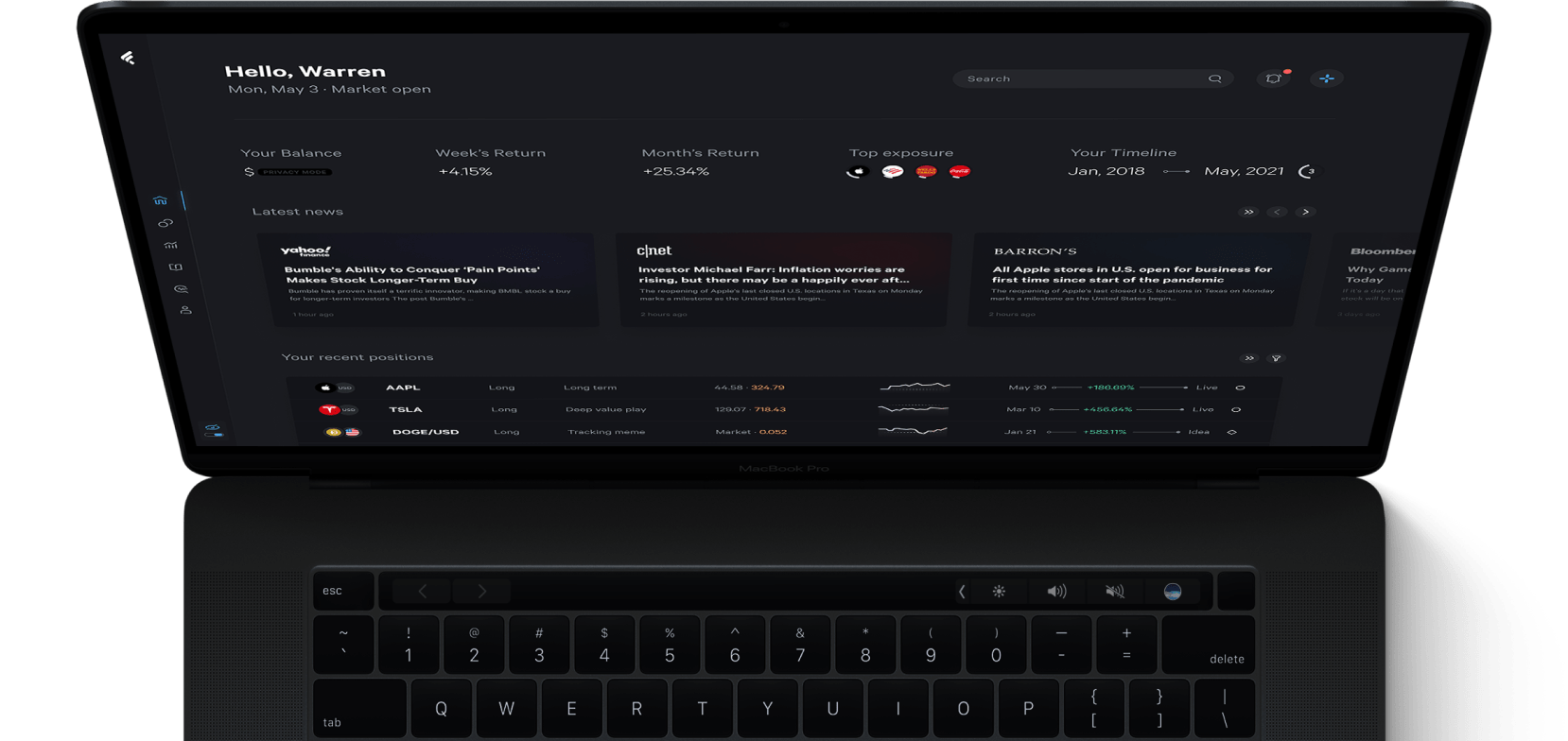

That’s why Fey stores all of your charts and notes, automatically keeping them organized and linked to both your live positions and your trade ideas — hypothetical positions that you’re not ready to take just yet, but want to watch the performance of over time. And when data does need to be pulled in from an external tool (like a charting platform or your broker), Fey will automate all the steps in-between.

Keyboard navigation is one other way that speed is core to journaling with Fey: with just a quick key shortcut, you’ll be able to navigate anywhere within your journal and execute nearly any action.

Design

To design a trading journal that’s actually fast and fun to use, we believe it’s necessary to think outside the box — or in this case, the spreadsheet.

Yet as the screenshots we highlighted show, most trading journals today consist of seas of table cells filled with context-free numbers, and charts that often seem to serve as visual filler, wrapped up in interfaces that are enough to make one yearn for the days of the command line.

In our years of developing products, we’ve seen how good design has the power to simplify the complex, and transform the tedious into the enjoyable.

Fey is for anyone that wants to become a more thoughtful, well-informed investor. But confusing or visually unappealing products alienate all but the most committed users, who are willing to power through a poor experience. We personally aren’t — and we don’t think anyone else should have to either.

In our years of developing products, we’ve seen how good design has the power to simplify the complex and transform the tedious into the enjoyable, which empowers people to learn and accomplish things they’d never imagined before. To help a new generation of traders grow and keep committed to it, Fey needs to be something that investors actually look forward to opening up.

That’s why we’re designing Fey to be easy on both the eyes and mind, with dark colors that make it comfortable to journal for hours at a time, an interface that’s quick to navigate and always highlights the most critical information first, and charts that are actually there to keep traders informed.

Community

We’re committed to helping investors grow over the long-term, and making it easier for them to share their ideas and their progress with whoever they want. That’s why we’re building features like a privacy mode that lets you view and share your Fey dashboard with others while keeping all sensitive information hidden, and the ability to create public links to your positions and trade ideas that include your charts and notes so other traders can follow along.

Beyond that, we believe the most critical part of building an engaged community is to constantly adapt the product to their needs and feedback as investors — something our early access feedback has shown us that existing solutions fail to do. We believe that the best way for us to do so is to launch Fey to a small number of early access users first, onboarding each one-on-one to guarantee a great experience, and charging a low monthly fee for access.

As the team behind Fey, Narative is part independent product developer, and part studio-for-hire. We want to keep control of our ideas and the quality of their execution within our team, and that means our funding for the products we build comes directly from our customers — and those are the people we want to stay accountable to.

While free (or “free*”) products ultimately tend to attract many more users, our goal isn’t to get Fey to a million users ASAP.

What’s next

Whether you’ve never kept a trading journal before or are already a daily die-hard, we’re looking forward to showing you more of the ways Fey will change the way you think about trading.

Fey is the ultimate investing experience built from the ground up, meticulously designed for the self-directed investor.

If you’re already requested access to Fey — thank you for helping us get here. There’s much, much more to come.